- Buy now pay later apps are trending in India, offering the convenience of purchasing a product and paying for it later based on credit score.

- Top 5 best buy now pay later apps in India for 2026 include FreeCharge, ZestMoney, MoneyTap, Sezzle, and Paytm Postpaid.

- These apps provide benefits such as easy repayment options, no interest EMIs, and partnerships with various merchants for seamless transactions.

Buy now pay later apps are trending in India. Everyone wants to join this race to get the product they want and pay for it later. But, it is not that easy because to get this feature, the one thing that matters the most is your credit score or CIBIL score. But that’s a different topic.

The second most important thing to get this service is choosing the best buy now pay later apps. So, we have come here to take away your troubles with our complete list of best buy now pay later apps in India that you can use. Therefore, let’s not increase your anxiety and start directly with the guide.

Best Apps for Buy Now Pay Later in India 2026

So, here are the top best buy now pay later apps that you can use in India. Read this guide carefully so you can get the most out of it:

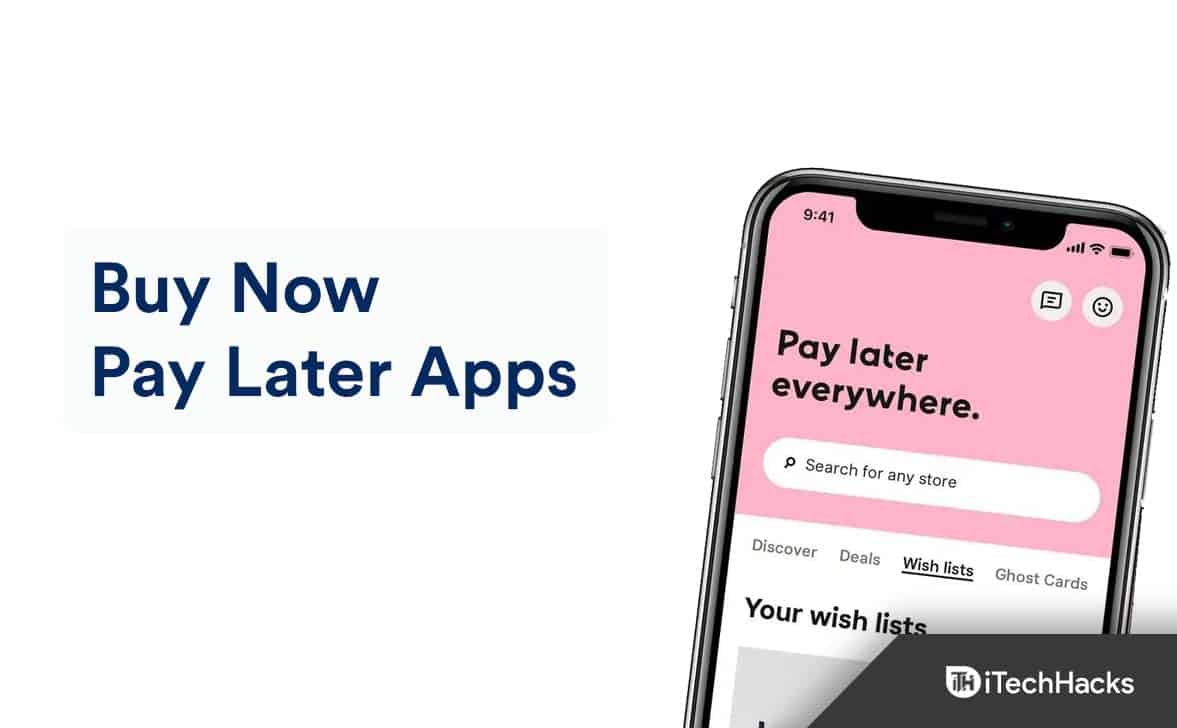

1. FreeCharge

Axis Bank offers Freecharge Powered by Freecharge users the option to purchase credit up to Rs 10,000 each month by using Freecharge Buy Now Pay Later. With Freecharge or its merchants/partners, users are able to make purchases/payments with a seamless one-click experience with the option to repay the dues over a period of up to 30 days.

You will be able to meet all your requirements immediately if you choose the Buy Now Pay Later option. With a pay-later service, you can purchase goods or hire service now and pay for it later if you find yourself short of funds for any reason.

Pay now on Freecharge and pay later at merchants that accept Freecharge Pay Later for items such as Mobile, DTH, Electricity, Landline, Broadband, etc.

The Freecharge Pay Later program is available to salaried people earning over 10k and with a CIBIL score of 720 or higher.

Benefits of Freecharge’s Buy Now Pay Later Service:

- Pay with a single tap.

- Repayment is easy: Pay once a month on the 5th. The amount spent can be repaid within 30 days.

- Streamlined and faster bill payments.

- Discounts and promotions are available.

- You have one month to repay them.

- The platform supports one-tap payments secured with a PIN or OTP.

- The interest you pay on your bill, if any, will be refunded to your Freecharge account as cashback.

- There are no processing fees

- With more than 25,000 retailers, including Myntra, Swiggy, and Zomato

2. ZestMoney

There is a growing trend of buying now and paying later in India. Therefore, people are finding more and more ways to shop on credit, from applications to credit cards. Further, Zest offers EMIs with 00/0% interest and the option of making payments over a period of 3 to 4 months at no extra charge.

With Zest, you can shop at more than ten thousand online and 75 thousand offline stores, including Amazon and Flipkart. Consumer lending fintech company ZestMoney has been growing rapidly in India since it was founded in 2016. With ZestMoney, you can shop on EMI for free instantly.

It is not necessary for you to have a credit card or debit card to use ZestMoney. There is no offline component to Zest. Zero pre-closure fees apply to loans taken out via Zest. If you are in a cash crunch or lack credit history, Zest can help you if you cannot get financing elsewhere.

The process is simple. Install the Zest App, verify your mobile number, and submit KYC documents in order to get a credit limit. With Zest, you can pay with any payment method. However, EMI plans must be chosen, and the purchase must be made. Your bank account can also be set up to automatically repay your debt.

Benefits of Zestmoney’s Buy Now Pay Later Service:

- No cost EMI without a credit card.

- Flexible EMI options.

- Paperless.

- It doesn’t charge any fees for interest on the product you purchase on EMI.

- Instant $50 Loan approval and disbursal.

- Personalized credit limits up to 2 lakh.

3. MoneyTap

Buy Now Pay Later is a new feature added to MoneyTap’s popular lending platform on Wednesday. Users would be able to pay on a flexible schedule while making purchases at various online and offline merchants, including 0% EMIs.

Recent developments in the Indian market have given rise to ‘Buy Now Pay Later’ credit. Millennials are using credit options at the checkout counter when making big-ticket purchases, even though the idea of installment loans is not new, MoneyTap said.

A total of 10,000 merchants are set to offer 0% and low-cost EMIs through MoneyTap, according to the company’s CEO. In addition, the digital lending platform will launch an EMI card backed by special offers in the next six months.

An interest-free period of 30 days will be offered with the 0% EMI Pay Later Card. Pay later cards to allow users to pay partially or in full after 30 days, then convert the rest into EMIs once they have paid the balance.

Benefits of MoneyTap’s Buy Now Pay Later Service:

- No cost EMI without a credit card.

- Flexible EMI options.

- Discounts and promotions are available.

- You have one month to repay them.

- The platform supports one-tap payments secured with a PIN or OTP.

4. Sezzle

Pay later on thousands of products at shops such as Target, Bass Pro Shops, and Lamps Plus through Sezzle, a company that offers “buy now, pay later” plans. You can divide your purchase into installments at checkout rather than paying it all in one shot.

There are no interest charges for using Sezzle’s plan, but some fees may apply. Like Afterpay and Klarna, Sezzle provides BNPL services. BNPL is an affordable form of financing if you keep up with your payments in a timely manner, but it is still a form of debt, and NerdWallet recommends you always pay in cash for nonessential expenses.

A unique feature of Sezzle is its certification as a B Corp. Companies that are designated as B Corps must undergo rigorous assessments and demonstrate environmental and social sustainability.

A U.S. or Canadian phone number, and email address verified with a debit or credit card, and a U.S. or Canadian phone number are required to register for Sezzle. Your initial spending limit will be determined by what Sezzle thinks you can afford to repay.

The company makes approval decisions instantly. You should be able to increase your credit limit if you make all payments on time.

Benefits of Sezzle’s Buy Now Pay Later Service:

- There is four pay plan.

- Over 10,000 online retailers connected

- A decision is made instantly on all approvals

- Multi-integration capabilities

- Support that is robust

- Payments with no interest

5. Paytm Postpaid

Shoppers Stop, Reliance Fresh, Haldiram, Apollo Pharmacy Croma, and Shoppers Stop, among others, accept Paytm Postpaid for grocery, milk, and other home essentials.

Payment history with Paytm determines your eligibility with the NBFC and Paytm.

You will be asked to provide Paytm with the history of your transactions and the type of payment you made. In addition, the CIBIL score will be checked when you request a credit limit from the app. We will consider these factors when granting credit limits and approvals.

If you wish to receive Paytm Postpaid, you must be at least 18 years old. We will generate monthly Postpaid bills on the 1st of each month. Every 7th day of the month, which is the Paytm postpaid payment date, you must pay the bill through UPI, Debit Card, or your bank account.

If you pay your bill regularly, your Paytm postpaid limit will increase. EMIs are also available when you pay back your PAYTM POST purchases so that you can pay back the amount in easy installments without having to worry about budget constraints.

Benefits of PayTM Postpaid’s Buy Now Pay Later Service:

- One-click checkout with super-fast processing

- Online and in-store acceptance at more than 5 lakh shops

- Their partnerships include Domino’s, Croma, Indian Oil, and more

- It is an entirely digital process

- EMIs or full payments are available

- No activation fee is required

From Author’s Desk

So, that’s it on our list of best buy now pay later apps in India that you can use in 2022. Hopefully, you will find our recommendation helpful. Moreover, if you want to ask any questions regarding the apps we have recommended, comment below and let us know.

RELATED ARTICLES:

- How To Transfer Money From PayPal To Cash App

- PandaHelper Alternatives 2026 | Best Apps Like Panda Helper

- 5 Best Instant Loan Apps in USA 2026 | $50-$100 Loan Instant App

- Activate HBO Max with 6 Digit Activation Code at activate.hbomax.com

- How to Review PayPal Recent Login Activity 2026

- How to Use Comenity EasyPay for Your Bills: Comenity Easy Pay Express Login