- Capital One offers a popular Platinum Card with beneficial features and rewards, requiring activation at www.capitalone.com/activate for full benefits.

- Key features include no annual fee, credit limit increase opportunities, fraud coverage, and credit monitoring through CreditWise.

- Activation methods include online, phone, and customer support, ensuring prompt and secure access to the card's advantages.

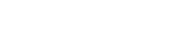

With its diverse range of credit card products, Capital One caters to the diverse financial needs of the consumer. Capital One’s Platinum Card is one of its most popular offerings. It comes packed with exciting benefits and rewards. It is necessary to activate the Capital One Platinum Card through the www.capitalone.com/activate website in order to enjoy all of these benefits. Here, we provide a detailed guide to Activating the Capital One Platinum Card and delve into its main features and benefits.

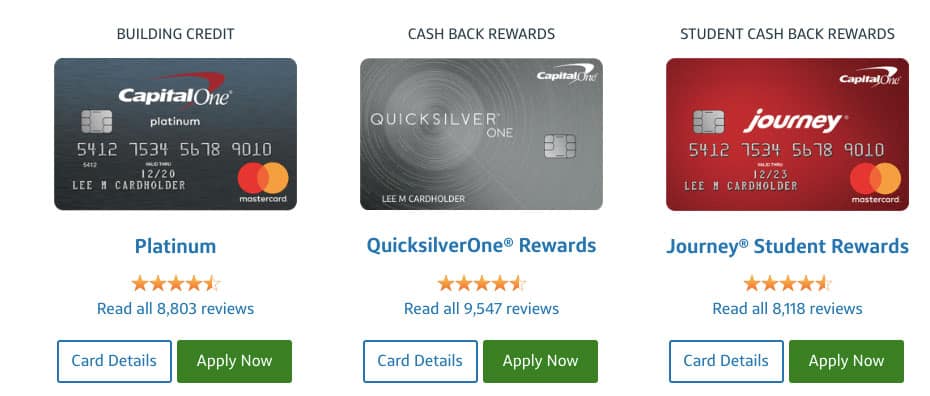

What is the Capital One Platinum Card?

In order to improve their credit score or rebuild their credit, Capital One Platinum Card can be helpful. The program is especially beneficial to people with limited or fair credit histories. In spite of the fact that the card does not offer rewards or cash back, it provides essential features that can improve a cardholder’s credit score over time. So, before we start with our guide on how to activate the Capital One Platinum Card using the www.capitalone.com/activate link, let’s check out some key features of this card in the next section.

| Official Website | Capitalone.com |

| Online Activation Link | www.capitalone.com/activate |

| Sign In Link | https://verified.capitalone.com/auth/signin |

What Are The Key Features and Benefits?

- No Annual Fee: Its primary advantage is the fact that there is no annual fee associated with the Capital One Platinum Card. Thus, cardholders will not have to pay any additional fees when using the card.

- Credit Limit Increase: Capital One Platinum Card holders can increase their credit limits if they behave responsibly with their cards.

- Fraud Coverage: Customers of Capital One are not held responsible for unauthorized transactions made with their cards, thanks to Capital One’s robust fraud coverage.

- CreditWise: It is possible to monitor the score of your credit card with Capital One’s CreditWise tool, via which you can keep track of your progress and make informed financial decisions.

Activate Capital One Platinum Card Using www.capitalone.com/activate 2023

| Activate Via Phone | Activate Online | Activate Via Customer Support |

|

|

|

Tips for Activating Your Capital One Credit Card

- It is important to activate your card as soon as possible after receiving it. If you haven’t activated your card, there’s no point in waiting. You do not want to risk losing the card you have been sent and having it fall into the wrong hands, even though it is not usable until you verify you have received it.

- You may be asked by Capital One to provide personal information in order to verify receipt of your credit card. Moreover, you will not be subject to this additional scrutiny if you log in via the app or call the number using your associated phone number.

- It is important to keep your card safe once you have activated it in order to prevent it from being stolen. To prevent additional charges from being made, contact Capital One immediately if your card is lost or stolen to report the theft.

- Also, you can earn bonus points if you meet the requirements of your card’s welcome bonus. It is not uncommon for the cards to require a specific amount of spending.

Some Frequently Asked Questions-FAQs

How do I set or change my PIN?

After you have activated the card using the www.capitalone.com/activate link, you may need to change the PIN for first-time use. So, for 360 Checking debit cards, you can set or change your PIN online or through the mobile app by logging in to your account online or through the app.

To change your PIN, visit Account Services & Settings (online) or Debit Card Help (app). If you would like to set or update your four-digit PIN, follow the instructions. Using this method, you will be able to withdraw money from an ATM.

Is it possible to recover a stolen or lost debit card?

Whenever you lose or steal your 360 Checking debit card, you can replace it by logging into your account. Upon following the instructions, a new card will be mailed to you via USPS within 5-7 business days. If your card is lost or damaged, you can replace it by logging in and selecting ‘Replace a Lost Card’ or ‘Replace a Damaged Card.’ However, you must disable your existing card immediately if you replace a lost one. You can still use your old debit card number while you wait for your new card to arrive and switch on.

How to use the Capital One Platinum Card wisely

- If you want to build or rebuild your credit, the Capital One Platinum Card is an excellent tool.

- There is no annual fee on the Capital One Platinum Card; however, you must avoid any late payment fees or cash advance fees that may apply. Paying your bills on time and keeping track of your spending will help you avoid unnecessary charges.

- Your credit score may improve as you use Capital One credit cards responsibly and build a strong credit history.

From Author’s Desk

The Capital One Platinum Card is a valuable financial tool that can help individuals improve their credit scores while enjoying essential benefits like no annual fee and credit limit increases. By activating your card through www.capitalone.com/activate, you gain access to a world of financial possibilities. So, that’s all we have for you from our side on how to activate Capital One Platinum Card using the www.capitalone.com/activate link. We hope that this guide has helped you. In the meantime, if you need more info, comment below and let us know.

ALSO READ:

- Activate Hotstar TV Code at www.hotstar.com activate on All Devices

- How to Activate Skylight Paycard Login at skylightpaycard.com Online

- Activate UKTV Play at uktvplay.co.uk Login Enter TV Activation Code

- MyCigna Activate Card and Login 2023 Steps to Activate MyCigna.com Card

- How to Activate Nordstromcard.com and Login with Step by Step Guide

- How to Check Amex Gift Card Balance at balance.amexgiftcard.com

- How to Activate Sam’s Club Credit Card via samsclubcredit activate

- Activate Fintwist Card at fintwistsolutions.com Activation Code